how to reduce taxable income for high earners 2020

Foreign Income Tax Credit-300. You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except.

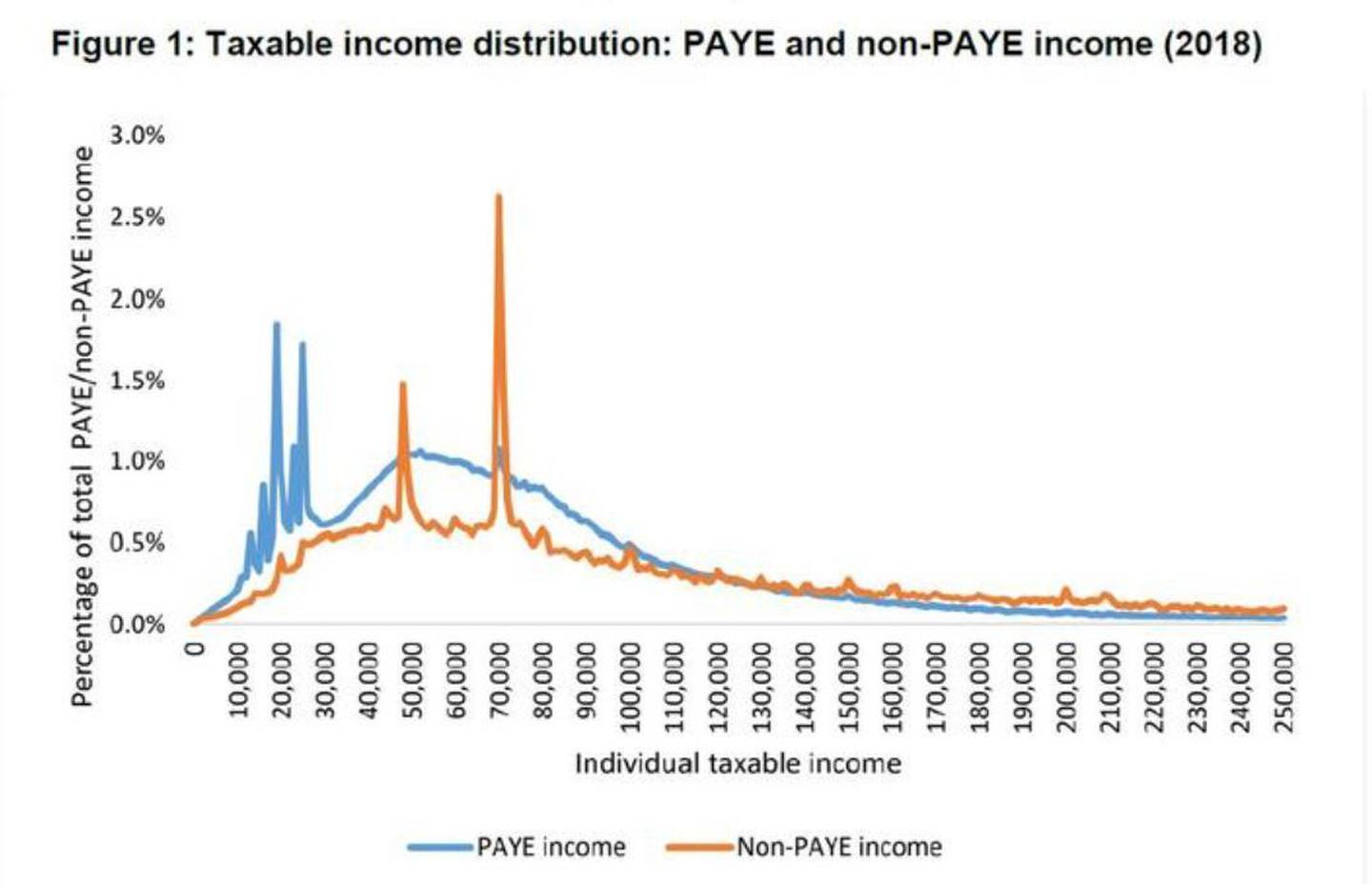

High Income Earners Likely Trying To Avoid New Tax Bracket Ird

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth Statutory Marginal And Average Tax Rates As Percent Of Taxable Income Download Scientific Diagram Share this post.

. Fortunately there are many ways high earners can reduce the taxes on their income. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. How to reduce taxable income for high earners through your employer benefits.

The contribution you will make will come straight out of your. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. If your work or assets generate significant income you could pay up to half of your earnings to the US.

Tax on 6500 of Qualified Dividends. Typically the IRS limits deductions for charity donations to 60 of a taxpayers adjusted gross income. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill. As you know a tax deduction shrinks your tax bill by shrinking your taxable income. With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time.

The income and even the interest payments from tax-exempt bonds are exempt from tax. A Roth retirement account has its own benefits but it wont reduce your income this year. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

Claim all the deductions you can. You can reduce taxes on your high-income earnings by deducting accrued interest related to investment activities. This means when your bond matures your original investment is returned without being taxed.

50 Best Ways to Reduce Taxes for High Income Earners. In 2020 the max amount you were able to put into your 401k was just under 20000. July 24 2020 225242.

Refundable Child Tax Credit-1286. By adding more money to your savings and using it while youre retired you could be put into a lower tax bracket when that time comes. Max your pre-tax 401k.

For example in 2020 we plan to deduct all of the following from our taxable income. 6 Tax Strategies for High Net Worth Individuals 1. A donor-advised fund DAF is an investment account created to support charitable organizations.

Buy tax-exempt bonds. Here are five tax saving tips that are easy to apply. Most employers will give you the option of a pre-tax or a Roth 401k.

High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. There are many strategies to help you maximize your charitable contributions and reduce your income tax.

Tax-exempt bonds might not be the most glamorous investment but is a good way to reduce your taxable income. Youll be paying taxes at a lower rate than you would of when you were making a high income. In addition to creating additional income a side business offers many tax advantages.

If for example you earn 70000 and take a 5000 deduction your. How to Reduce Taxable Income. But the organization lifted this limit temporarily for the 2020 and 2021 tax years.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA. How to Reduce Taxable Income for High-Income Earners in 2021 Max Out Your 401 k Have a Plan for Your Non-Retirement Account Assets Bunching Donor Advised Funds DAF Contribute to Your HSA.

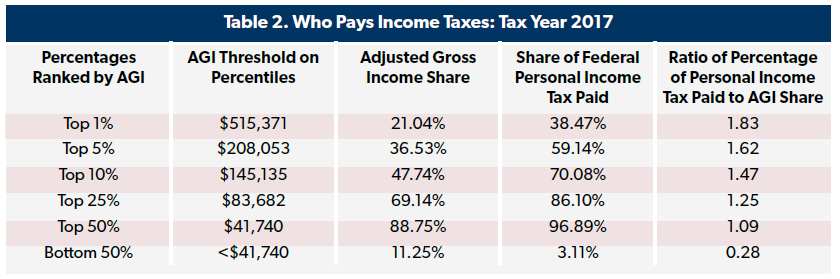

According to the IRS high-income earners pay almost 70 of the total federal income tax they collect. Newer Post Older Post Home. Now taxpayers can take a deduction of up to 100 of their adjusted gross income.

Maximize contributions to your retirement plan. Capital losses in excess of 3000 can be carried forward to later tax years. To reduce your reportable income you should start with maxing out your pre-tax 401k.

How to reduce taxable income for high earners 2020 Saturday May 7 2022 Edit.

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

5 Ways To Save Taxes For Middle To High Income Earners In Singapore 2022

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

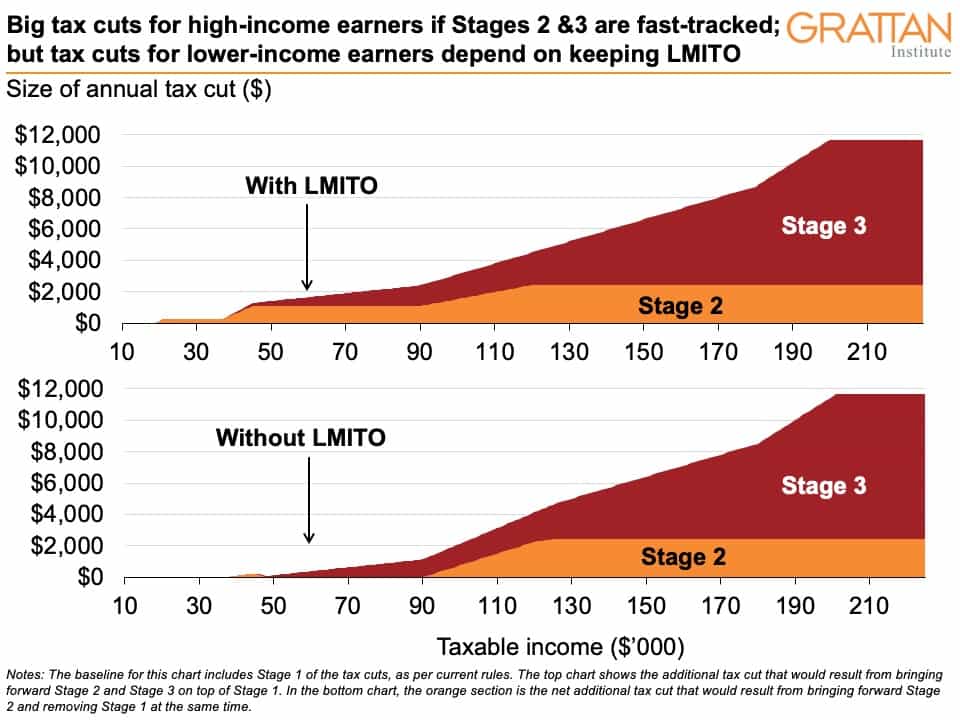

How To Reduce Taxes For High Income Earners Australia Ictsd Org

How To Reduce Your Tax Bill For 2020 Summitry

Republic Of Armenia In Imf Staff Country Reports Volume 2019 Issue 031 2019

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Explainer The Argument Over Personal Income Tax Cuts Grattan Institute

7 High Income Tax Strategies To Reduce Taxes No Brainer Wealth

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Deductible Childcare The Worst Of All Worlds Grattan Institute